Technological equipment, or as it is often called Machine tools, is a specific type of equipment designed to secure and correctly position the workpiece on the machine for subsequent machining. It is used at various technological stages of production, where rigid fixing of parts and assemblies is required: metal cutting, control, Assembly. But the most popular are machine tools, the complexity and dimensions of which depend on the type of technological process, the configuration of the manufactured part and the serial production.

You can classify the types of technological equipment based on different criteria. For example, depending on the type of machine used:

-

lathes

- drilling

- milling machines

- boring and others

Depending on the level of automation, the devices can be:

- with the use of a manual clamp

- mechanical

-

semi-automatic and automatic types

According to the degree of specialization-universality, the following types:

Depending on their intended purpose, devices are divided into five groups:

Separately, we would like to consider machine tools for milling. All milling devices can be divided into groups:

According to forecasts, the global machine tool market (of which technological equipment is a part) is expected to grow from $ 113 billion in 2019 to $ 151 billion by 2027 with an average annual growth rate of 4.5%. The production of machine tools is affected by the demand for automotive, industrial and transport equipment. In addition, suppliers pay special attention to the digital transformation of equipment due to the gradual but massive transition from conventional machines to CNC machines.

This transformation is the result of high demand for performance, quality, and reduced cycle times in the end-user industry. For example, in August 2020, the company TGM Ltd. invested us $ 1.43 million in the implementation of CNC technologies for large firms in the field of aerospace defense. With the introduction of these new technologies, the company expects to double its sales in just two (!) years. This case is not an isolated one, which allows us to count on the rapid stabilization of demand and production levels during a tense situation due to the coronavirus.

Geographically, the Asia-Pacific region occupies and is projected to occupy a large part of the market-this is due to growing demand from the automotive, aerospace and construction industries. In addition, we have already mentioned the "Make in India" campaign earlier in the industry news - it encourages foreign direct investment in the country and offers tax incentives, which certainly has a positive impact on demand.

- Universal devices are distinguished. Designed for processing various parts. The use of such devices does not require replacement of mounting and clamping elements.

- Special device. Used for processing a certain type of parts.

- Changeable devices, which in turn are divided into three groups:

- universal adjustment devices (UNP). They consist of two main parts: permanent (universal) and replaceable (adjustment). they are used for processing parts that are similar in design and technological characteristics to all types of mass-produced machines;

- specialized adjustment devices (SNP). They consist of a basic unit and a replaceable adjustment, while the base part is 80% ready-made device, used for geometrically similar workpieces in mass production;

- universal-prefabricated devices (USP). They are devices that are assembled from a set of previously manufactured parts and Assembly units. From the USP kit, you can quickly assemble various milling, drilling, turning and other devices.

Depending on their intended purpose, devices are divided into five groups:

- machine tools;

- fixture for mounting a working tool;

- Assembly devices;

- control devices;

- devices for gripping, moving and turning processed workpieces.

Separately, we would like to consider machine tools for milling. All milling devices can be divided into groups:

- Universal, having high rigidity not only of the body itself, but also of the clamping devices. These include:

- universal dividing heads (used for turning when milling the workpiece to the desired angle);

- optical dividing heads. Used when performing particularly precise work, when you need to rotate the workpiece at an angle with an error of no more than 0.25;

- universal rotating tables. They are part of a milling machine and are used when necessary to rotate the workpiece in a horizontal plane;

- corner table. They are used for setting the workpiece at an angle relative to the milling machine table;

- rotary tables are designed for circular milling at certain regular intervals.

- Standard and universal milling devices, which include:

To consider the market of technological equipment in isolation from the market of machine tools would not be quite correct and correct. Therefore, we will review them together.

- pneumatic and rotary vises. Used for milling workpieces along the contour;

- pneumatic devices without reinforcing devices, in such devices the workpiece is clamped by a rod, they are used for small cutting forces;

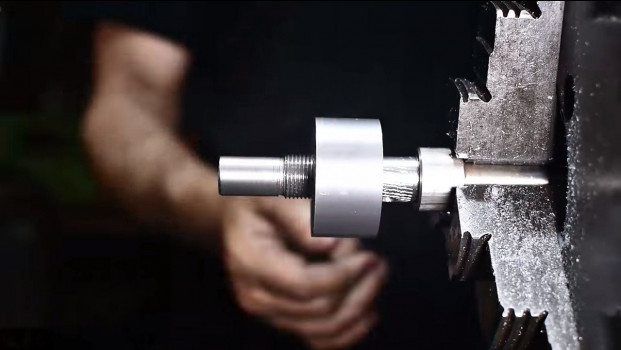

- clamping device with a wedge-type mechanism. The most common type of device, the main advantage of which is the constant clamping force and high rigidity of the structure, which is a necessary component for installing the workpiece on untreated surfaces;

- multiple seats with pneumatic drive. Used for milling the ends of cylindrical parts.

According to forecasts, the global machine tool market (of which technological equipment is a part) is expected to grow from $ 113 billion in 2019 to $ 151 billion by 2027 with an average annual growth rate of 4.5%. The production of machine tools is affected by the demand for automotive, industrial and transport equipment. In addition, suppliers pay special attention to the digital transformation of equipment due to the gradual but massive transition from conventional machines to CNC machines.

This transformation is the result of high demand for performance, quality, and reduced cycle times in the end-user industry. For example, in August 2020, the company TGM Ltd. invested us $ 1.43 million in the implementation of CNC technologies for large firms in the field of aerospace defense. With the introduction of these new technologies, the company expects to double its sales in just two (!) years. This case is not an isolated one, which allows us to count on the rapid stabilization of demand and production levels during a tense situation due to the coronavirus.

Geographically, the Asia-Pacific region occupies and is projected to occupy a large part of the market-this is due to growing demand from the automotive, aerospace and construction industries. In addition, we have already mentioned the "Make in India" campaign earlier in the industry news - it encourages foreign direct investment in the country and offers tax incentives, which certainly has a positive impact on demand.

Main drivers of market growth:

There are a number of characteristic features on the Russian market. In 2015-2017, there was a decline in sales of machine tools and equipment. This was due to the difficult economic consequences of 2014 and the decline in imports of machine tools due to the sharp weakening of the ruble. By 2018, the situation had stabilized, partly due to the adaptation of the Russian economy to new conditions, and partly due to state programs for the re-equipment of Russian industry. But it did not stabilize for long - in 2019, and most likely in 2020, there was a decline in sales due to the stagnation of the economy, a reduction in investment in fixed assets, and the continued weakening of the Russian currency.

For many years, the share of machine tool imports was 90%. Today, according to the estimates Of the Association "Stankoinstrument" - about 80%. There are reasons for this: the government continues to develop support programs, and rostec is creating a machine-tool cluster to meet domestic demand. Another important point is that scientific research in the field of mechanical engineering in value terms accounts for 0.5% of GDP. The science intensity index, which is calculated as the ratio of industry costs for research and development to production, ranges from 1.5 to 2.3%. The share of innovative products in total production does not exceed 8-11%. A little for successful development. So in General, we have a lot to grow.

Key global manufacturers of process equipment:

- Growing demand for smart machines. Technological advances, such as the increasing adoption of robotics and human-machine interaction, are driving the market growth. Real-time connectivity requirements further support this trend. The market is in demand for intelligent tools equipped with sensors to optimize the working time of the machine and plan maintenance. You can analyze this data and improve performance. The sensors can predict the life cycle of the tooling used on the machines-this will reduce downtime. It is expected that the increasing introduction of intelligent functions, such as reducing energy consumption in these tools will contribute to the growth of the market from the point of view of income.

- The growing spread of additive (3D) manufacturing and hybrid machine tools to increase demand. Manufacturers moving to cost-effective and fast production processes are increasingly adopting 3D manufacturing. Manufacturers of CNC machines are planning to introduce additive manufacturing into their business. For example, Okuma plans to introduce new Laser EX machines in the future that will include laser quenching of carbon steel along with laser-fired heating and self-cooling quenching. It is expected that such examples of innovative technologies will contribute to further market growth in the coming years.

There are a number of characteristic features on the Russian market. In 2015-2017, there was a decline in sales of machine tools and equipment. This was due to the difficult economic consequences of 2014 and the decline in imports of machine tools due to the sharp weakening of the ruble. By 2018, the situation had stabilized, partly due to the adaptation of the Russian economy to new conditions, and partly due to state programs for the re-equipment of Russian industry. But it did not stabilize for long - in 2019, and most likely in 2020, there was a decline in sales due to the stagnation of the economy, a reduction in investment in fixed assets, and the continued weakening of the Russian currency.

For many years, the share of machine tool imports was 90%. Today, according to the estimates Of the Association "Stankoinstrument" - about 80%. There are reasons for this: the government continues to develop support programs, and rostec is creating a machine-tool cluster to meet domestic demand. Another important point is that scientific research in the field of mechanical engineering in value terms accounts for 0.5% of GDP. The science intensity index, which is calculated as the ratio of industry costs for research and development to production, ranges from 1.5 to 2.3%. The share of innovative products in total production does not exceed 8-11%. A little for successful development. So in General, we have a lot to grow.

Key global manufacturers of process equipment:

- Bison-bial s.a.

- Fabryka Narzędzi PORĘBA Sp. z o.o.

- SMW-Autoblok

- Schunk

- AMF

- Allmatic

- Rohm

- Gerardi

- AutoStrong

- EWS

- Kemmler

- Kintek

- Pagnoni

- Vertex

- WTO

- Samchully

- Zentra

- Babel

- Pozos

Traditionally, we will consider the key Russian manufacturers of technological equipment (some manufacturers produce only a specific type of equipment, but they are well represented in Russia by this type, which is why they are included) and estimate their scale by gross profit for 2019 / / 2018 (in Russian rubles):

- JSC "Glazovsky plant Metalist" 169.9 million ₽ // 177 million ₽, i.e. -4%.JSC BelTAPAZ (Belarus) 87.6 million ₽ // 104.7 million ₽, i.e. -16%.

- JSC "Baranovichi plant of machine tools" (Belarus) 95.7 million ₽ // 101.7 million ₽, i.e. -6%.

- JSC "Orsha tool plant" 19.7 million ₽ // 30.8 million ₽, i.e. -36% - significantly" sank " revenue, increased management costs.

- Tool Saransky LLC 2.4 million ₽ / / 2.6 million ₽, i.e. -8%.

- JSC plant "VIZAS" (Belarus) -1.5 million ₽// 23.5 million ₽ - went into negative territory, as the share of cost increased and revenue decreased.

- Gomel mechanical plant CJSC-information is not available.

- LLC "Plant of Special Interchangeable Technological Equipment" - information is not available.

Russian and foreign manufacturers of technological equipment are represented at the Junwex virtual exhibition. Learn more - https://enex.market/en/catalog/stanki_i_komplektuyushchie_k_nim/stanochnaya_osnastka/.