To begin with, let's figure out what consumables are. In fact, these are materials that are consumed and worn out in the process of work, and used in conjunction with any tool. They have a short service life, after which they are subject to replacement with new ones, or additional manipulations in the form of sharpening, etc.

It is possible to classify consumables based on:

- Processed material/type of work performed:

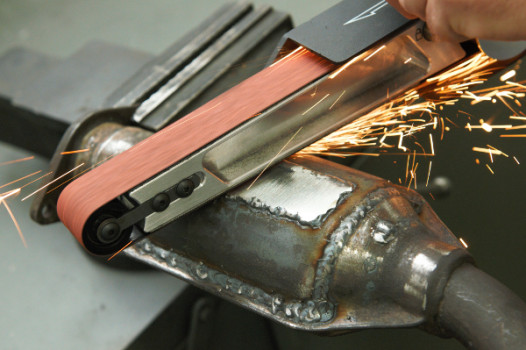

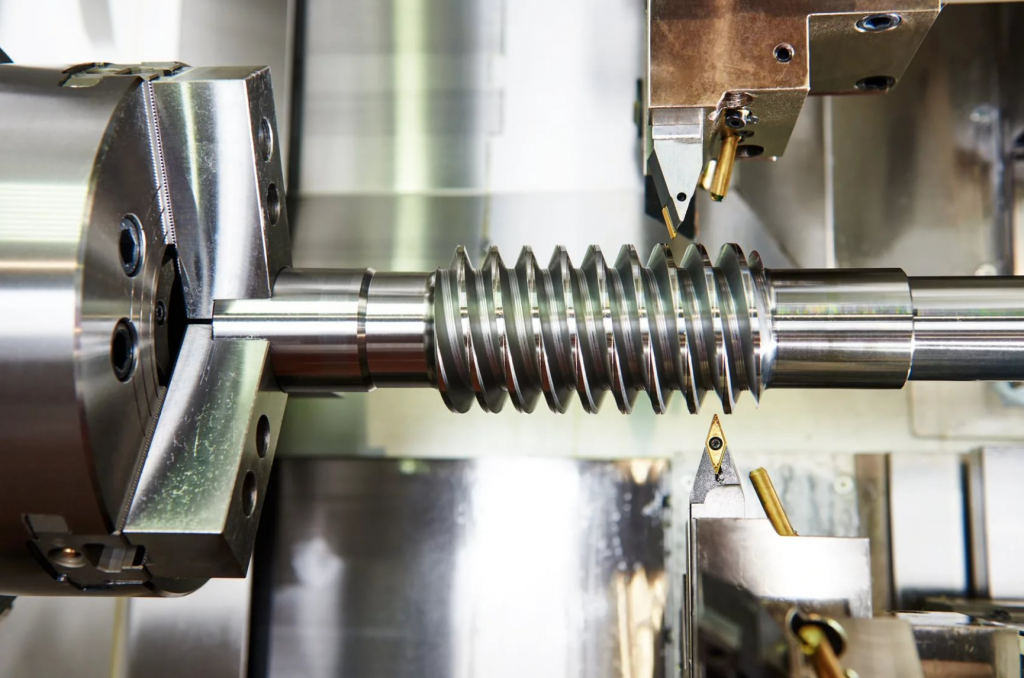

- Metalworking - such as drills, bores, metal cutters, cutting and sharpening circles, grinding materials, hacksaw blades, saw belts, etc.

- Woodworking - such as cutting discs for circular saws, blades for electric jigsaw, wood drills, wood cutters, etc.

- For work with stone, tile and concrete - diamond-coated discs, chisels, drills, etc.

- For welding work - welding wire, rods, electrodes, solders, etc.

- The type of tool with which they are used: Abrasive materials, materials for drills, cutters, saws, jigsaws, punchers and jackhammers, mounting and glue guns of welding machines and works, screwdrivers and wrenches, grinders, trimmers and mowers, etc. And of course, spare parts and batteries for the tools themselves.

The market for consumables is very large. Within the framework of our reviews of the tool markets, it can "compete" only with the market of power tools. Let's consider the main trends in the world market of consumables. Spoiler alert: it is characterized by stable growth. Learn more about each market segment.

Thus, the growth of the market of consumables for metal-cutting tools is projected at 3.5% annually for the next 5 years. Growth points of the cutting tool consumables market:

- Global industrialization,

- Growing demand from the automotive and oil and gas industries and electricity generation,

- The growth of such a sector of the economy as construction (steel structures are used in the vast majority of modern projects). And here an important role is played by the growing economies of India and China - participants of more than 40% of global construction growth in the world.

The growth of the market of consumables for abrasive tools is projected to be 5.2% annually. Growth points of the abrasive tool consumables market:

- 75% of the global abrasives market in 2021 was occupied by the synthetic segment. Aluminum oxide is the most widely used material. It has a longer service life, which allows it to be reused without loss of efficiency. As a result of the lower replacement frequency, aluminum oxide provides an exceptional price-quality ratio. There is an increase in the aluminum oxide segment - there will be an increase in abrasives in general.

- 43% of the global abrasives market in 2021 was occupied by the segment on the bundle. In the abrasives on the bundle, the grains join together to form a solid shape resembling a wheel. Abrasives on the bundle, such as cutting wheels, attachment wheels, segments, plugs and cones, can be used for various grinding operations and have a wide range of applications, with various binding agents providing various functionality. There is an intensive industrial use of this segment.

- The grinding segment held the largest share of 30% in the global abrasives market in 2021. Grinding, also known as abrasive processing, is the impact of irregularly shaped abrasive particles on a workpiece to remove metal in the form of microscopic chips. On the world market, there is an increase in the grinding use of abrasives.

- The Metal Production segment held the largest share of 28% in the global abrasives market in 2021. Abrasives are used for cutting, grinding and manufacturing a number of metals. The growing demand for steel and steel-related products is driving the abrasive industry.

- There is a growing demand for abrasives from the electronics and semiconductor industries, where they are used for the manufacture of printed circuit boards and other electronic devices.

- The construction industry has a high demand for abrasives, which are used almost everywhere.

In the market of tools (and consumables) for stone/concrete processing, a serious growth of 8.6% is expected annually. Moreover, it will be provided mainly by North America. This is justified by the fact that advanced technologies are being widely introduced there (the concept of "green construction", the demand for "smart cities") and large participants are actively coming to this territory, building "green" buildings from natural materials.

The market of consumables for woodworking also reflects several characteristic trends. The growing urbanization, many housing improvement projects in different parts of the world create huge opportunities for the growth of the woodworking market. But what is interesting is that Europe plays a key role geographically, since there are a large number of furniture manufacturers in this region. And besides, the DYI trend is also gaining momentum around the world.

It is also necessary to consider the constraints for the market of all consumables for tools:

- Progress does not stand still, and manufacturers are working to ensure that the wear resistance of both the tools themselves and their consumables is higher.

- In the process of work, consumables wear out, creating a high level of noise, dust, etc., which poses a danger to workers. Workplace safety organizations have expressed concerns about this.

In Russia, the situation with the consumables market correlates with the global one - unconditional growth. There are many manufacturers of various segments on the market - from the budget Chinese version to the best consumables from key players. There are a number of features characteristic of the Russian situation:

Despite the abundance of consumables for abrasive tools from a huge variety of manufacturers, the goods of domestic manufacturers are in the greatest demand on the Russian market. There are several reasons for this - due to the peculiarities of transportation, imported consumables often come out more expensive than their Russian counterparts. And our manufacturers themselves are constantly working to improve the quality of manufactured goods and services - and as a result, its competitiveness is growing, etc. There is also a general policy of import substitution in the country, and this affects both the market of consumables for abrasive and for metal cutting tools - according to various estimates, about 60% of consumables for metal cutting of domestic production.

Consumables from a huge number of different manufacturers are presented on the Russian market. In fact, every company that produces a tool also produces consumables for them. Of course, predictably, the leading role is occupied by global brands such as Bosch, Hilti, Makita, Stanley Black & Decker, Metabo, HiKOKI, etc. They produce equipment of any category. These brands have their local representative offices in Russia - for more information, see the overview of the power tool market.

Traditionally, we will consider the key Russian manufacturers of consumables and estimate their scale by gross profit for 2020/2019:

* Volga Abrasive Plant - 2.37 billion rubles // 2.02 billion rubles, i.e. + 17%.

* Luga Abrasive Plant - 2.18 billion rubles // 1.76 billion rubles, i.e. + 23%.

* Insvarkom (Svarog) - 566 million ₽ // 392 million ₽, i.e. +44%.

* Belgorod Abrasive Plant - 248 million rubles // 229 million rubles, i.e. + 8%.

* Skif-M Belgorod - 249.9 million rubles // 377.5 million rubles, i.e. -34%.

* Kirovograd Plant of Hard Alloys (KZTS) - 216.2 million rubles // 204.7 million rubles, i.e. + 5.5%.

* Anchor - 100 million ₽ // 105 million ₽, i.e. -5%.

* Khrapunov Tool Factory (KHIZ) - 55.5 million ₽ // 70.5 million ₽, i.e. -21%.

* Bestveld (Professional training, Bestweld) - 44.4 million ₽ // 40 million ₽, i.e. +11%.

* Tomsk Tool Plant (TiZ) - 10.4 million rubles // 18.5 million rubles, i.e. -43%.

* Berd Tool Factory (BIZ) - 3.6 million ₽ // 2.6 million ₽, i.e. +38%.

* Kanash Cutter Plant - 4.9 million rubles // 4.8 million rubles, i.e. +2%.

* Kirzhach Tool Factory (KiZ) - 3 million rubles // 3.1 million rubles, i.e. -3%.

* Kyshtym Abrasive Plant - 3 million rubles // 2 million rubles, i.e. +50%.

* Serpukhov Tool Factory (TWINTOS) - a loss of 5.7 million rubles // 15.1 million rubles.

* Novosibirsk Tool Plant (NIH) - at a loss of 33.5 and 27.1 million rubles in each year, respectively.

* Factory of abrasive and refractory materials - 0.

* Poltava diamond tool - 271 thousand ₽ // 359 thousand ₽, i.e. -24%.

* Ryazan Tool Factory - a loss of 1 million rubles.

* Snap-in Practice - no data.

The virtual exhibition Enex presents a variety of consumables from Russian and foreign manufacturers - https://enex.market/en/catalog/Raskhodnye_materialy/.